ri tax rate on unemployment benefits

For those employers at the highest tax rate the UI taxable wage base will be set 1500 higher at 26100. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children.

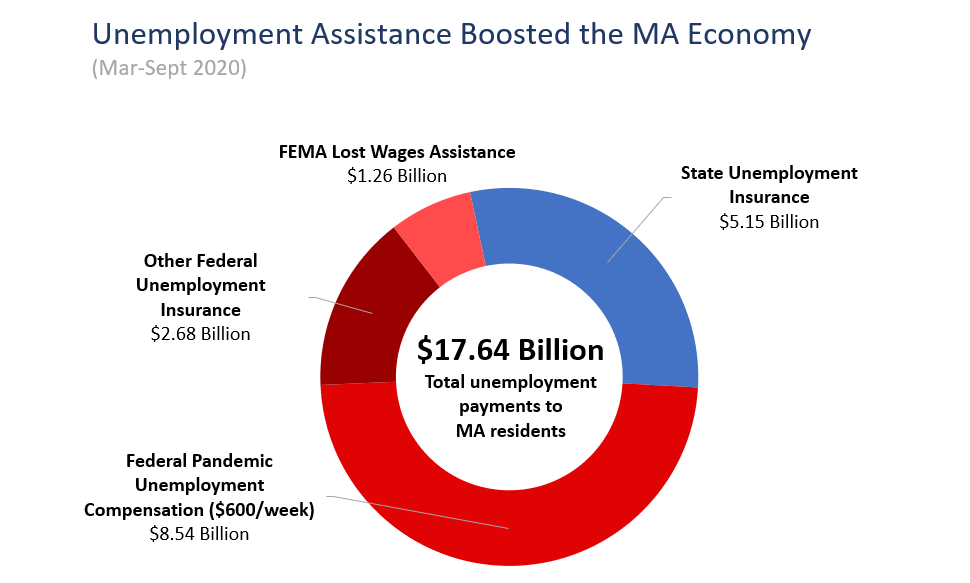

Unemployment Insurance Saved The Massachusetts Economy How Can We Ensure It Will Be Strong For The Future Mass Budget And Policy Center

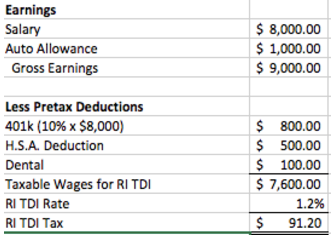

Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600.

. 52 rows Most states send employers a new SUTA tax rate each year. That means employers whose rates now range from 12 to 98 will see their rates remain steady. March 29 2021.

Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600. The rate for new employers which is based on the States five-year benefit cost rate for new employers will be 119 percent. Division reminds taxpayers and tax preparers about existing Rhode Island statute.

For those employers at the highest tax rate the UI taxable wage base will. UI provides temporary income. These rates include the 021 percent Job Development.

Under federal legislation enacted on March 11 2021 if a taxpayer received unemployment. Normally unemployment benefits are subject to both federal and Rhode Island personal income tax. The rate for new employers will be 119.

Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes. Generally states have a range of unemployment tax rates for established employers. Up to 25 cash back The state UI tax rate for new employers also known as the standard beginning tax rate also can change from one year to the next.

The rate for new employers. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent. The Rhode Island Division of Taxation today.

For most Rhode Island employers the taxable wage base for calculating the. For those employers at the highest tax rate the UI taxable wage base will. In recent years the employment.

CRANSTON Rhode Island businesses wont see an increase in their unemployment insurance tax rate for 2022 even though the trust fund that keeps benefits. Unemployment tax rates are.

Loss Of Low Wage Jobs Fuels Larger Unemployment Benefits For Highly Paid Workers The Boston Globe

Rhode Island Employee Retention Credit Erc For 2020 2021 And 2022 In Ri Disasterloanadvisors Com

Delays For Unemployment Benefits Persist Over A Year Into Pandemic

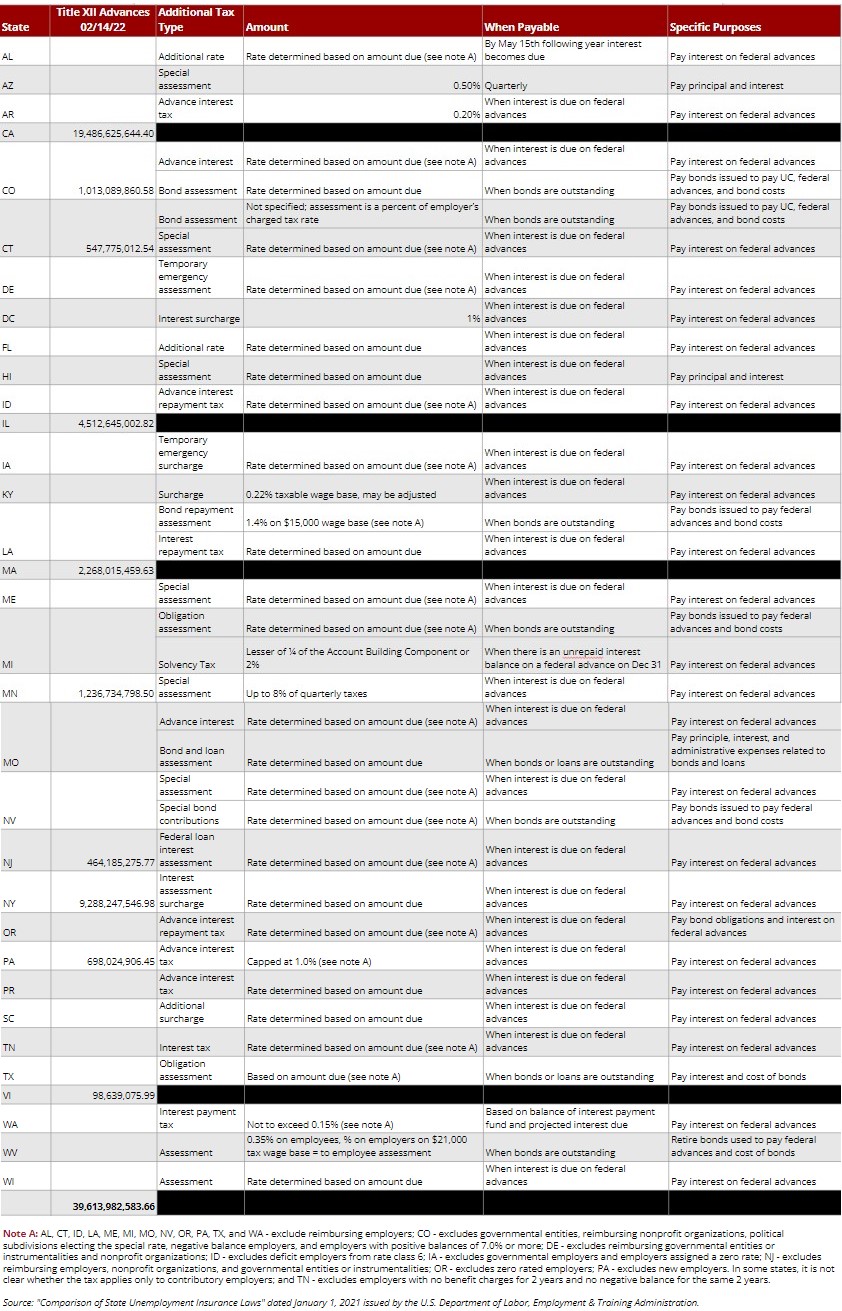

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Poverty Increased Most In States With Poorer Unemployment Benefit Systems

States With The Highest And Lowest Unemployment Benefits

State Unemployment Trust Funds 2021 Unemployment Compensation

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Unemployment Benefits New York And 10 Other States Are Still Taxing Unemployment Benefits Here S What That Means For You Cnn Politics

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Covid Unemployment Marketplace

View All Hr Employment Solutions Blogs Workforce Wise Blog

Analysis U S States Ending Jobless Benefits Early Hit Labor Market Milestone In March Reuters

Do You Have To Pay Taxes On Unemployment In 2021 Mmi

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back